Conceptualizing Health and Financial Wellness: Using Facilitated Discussion to Collect Input from Professionals

Elizabeth Kiss

Kansas State University

Suzanne Bartholomae

Iowa State University

Carrie L. Johnson

North Dakota State University

Barbara O’Neill

Rutgers University

Yilan Xu

University of Illinois at Urbana-Champaign

Michael Gutter

University of Florida

Abstract

Determinants of health and financial security are complex. Individuals and families must often weigh decisions about their health against considerations of their financial resources, and vice-versa. Financial wellness and capability influence consumers’ health outcomes both directly and indirectly. This article documents a facilitated discussion at the 2018 Biennial Conference of Family Economics and Resource Management Association (FERMA) that bridged the domains of health and personal finance. Organizers summarized connections between health and financial stress, well-being, and wellness, and discussed definitions of health literacy and financial literacy. Attendees shared perspectives about how consumers’ financial wellness and capability influence their education and outreach activities and consumers’ health outcomes. They also worked together to create integrated models of health and financial wellness that could increase the number of Americans who are healthy and financially well at every stage of life. Insights will guide future scholarship focused on intersections of health and financial wellness.

Keywords: financial literacy, financial well-being, health, health literacy, wellness

Introduction and background

Cooperative Extension’s National Framework for Health and Wellness (Braun et al., 2014) outlines a framework to increase the number of Americans who are healthy at every stage of life, a goal that is aligned with that of the National Prevention Council (2011). The framework focuses on facilitating healthy and safe environments as well as healthy and safe choices. Six priority areas have been identified to support these aims: health insurance literacy; health literacy; health policy issues education; integrated nutrition, health, environmental and agriculture systems; and positive youth health development. According to this framework, the public sector, the private sector, the education sector, health professionals, engaged university systems, clinical and community preventive services, community organizations, and engaged communities can all contribute to the efforts to improve health and wellness of Americans.

For instance, improving health literacy could help people make better health and health insurance decisions, but financial barriers may still exist that prevent them from taking the appropriate action. People may understand the best options for their health when it comes to decisions such as food choices, physical activity, health insurance, and medical treatments. Unfortunately, they might not be able to afford those best options. In addition, people who are financially constrained might not be able to move to a healthy and safe environment to avoid toxic and adverse environments, even if they know they should.

Extension’s framework for health and wellness does not explicitly account for the economic and financial dimension of healthy and safe environments and choices. Publications, particularly in the employee-benefit sphere, have begun to advocate for a health and wellness framework with an embedded financial perspective (O’Neill and Ensle, 2013; Pinsker, 2018; Unser, 2018). As those conversations continue, family resource management professionals may benefit from understanding the myriad connections between health and financial wellness. Our profession also has much to contribute to the national conversation. If, as we suspect, health professionals and financial professionals agree that health and financial wellness intersect, our ultimate goal is to make the case for a fuller model of health and wellness that includes financial aspects.

Thus, one purpose of the facilitated symposium conversation at the 2018 Biennial Conference of Family Economics and Resource Management Association (FERMA) was to introduce financial wellness into the broader context of health and wellness. A second purpose was to identify how health wellness and financial wellness intersect in daily life as observed by family and consumer sciences professionals in their professional settings. A final purpose was to introduce a facilitated symposium discussion as a program design to help Extension agents and others systematically collect input from a wide audience to explore new research areas. Each of those purposes is explained here more fully.

The symposium provided an opportunity to gather input from a variety of practitioners, Extension specialists, educators, and researchers who specialize in family economics, family resource management, and personal finance. This input will inform the design of future research, educational programs, and professional services to help improve the health and wellness of Americans beyond the scope of Cooperative Extension’s National Framework for Health and Wellness.

Why pair health and financial wellness?

This work is built upon well-established literature connecting financial status, financial stress, and financial literacy with health outcomes. For example, research on financial stress finds an association with a host of outcomes, including individual outcomes such as depression, somatic complaints, and poor physical health (Drentea and Reynolds, 2012; Nandi et al., 2012), and relationship outcomes such as marital and parent-child relationships (Conger, Conger, and Martin, 2010; Dew and Xiao, 2013; Fonseca, Cunha, Crespo, and Relvas, 2016). Literature is just emerging that links health literacy and financial literacy, and explores the association of these competencies in health and financial decision-making (James et al., 2012). In addition, financial and health decisions can be consequential at every stage of the life cycle, highlighting the importance of this pairing of health and financial wellness. Finally, whether considering health or financial wellness, it can be argued that the responsibility for either wellness is shared by both fields. Financial and health practitioners share common goals and techniques in their work. Cross-fertilization between fields might facilitate key insights and shared responsibility.

Design of facilitated discussion

The facilitated symposium discussion was led by a multistate research collaboration funded by the North Central Regional Association (NCRA) and Agricultural Experiment Stations at 18 universities. The project number is NC2172. Over the past five years, the team’s work has focused on behavioral economics and financial decision-making and information management across the life span. During the next five years, the group will focus on behavioral economics and the intersection of healthcare and financial decision-making across the life span.

This multistate team has existed for more than a decade and involves faculty from diverse backgrounds with primary emphasis on applied economics. The team members contribute according to their strengths, with some emphasizing methodological leadership and others focusing on literature and theory. The group uses secondary data when possible, but regularly collects primary data using mixed methods including focus groups, interviews, Twitter chats, and choice experiments conducted online.

The facilitated symposium discussion was designed to gain insights from practitioners. The desired outputs were an identification and insight into overlapping issues and concerns related to personal finances and health status and how these commonalities translate to interventions and outreach. The process involved small group discussions motivated by the following guiding questions:

- What do you see as the intersections between health and financial wellness?

- Where in your work do you see intersections of health and financial wellness?

- What would be your integrated model of health and financial wellness?

Session leaders guided small groups through these questions and then recorded the subsequent discussions and clarified some of the themes.

Defining core concepts

To ensure that participants in the facilitated discussion were working from a common set of definitions for well-being and wellness, accepted definitions were shared. One important clarification to be made was the similarity between the concepts of health and well-being. These concepts, while broadly agreed upon, still can be confounded with each other.

The very broad and long-established definition of health and well-being developed by the World Health Organization (1948) is as follows: “Health is a state of complete physical, mental and social well-being and not merely the absence of disease or infirmity.”

FERMA participants also considered a more recently developed definition of financial wellness from the Consumer Financial Protection Bureau (CFPB). The CFPB (2015) organized and spearheaded the conceptualization and measurement of financial wellness by considering evidence from existing literature and conducting fieldwork research with consumers, academics, and practitioners. As a result of this extensive work, the following definition of financial well-being was developed: “financial well-being can be defined as a state of being wherein a person can fully meet current and ongoing financial obligations, can feel secure in their financial future, and is able to make choices that allow enjoyment of life.” (CFPB, 2015)

To further shared understanding, accepted definitions of health literacy and financial literacy were also considered. Someone who is functionally literate can read, write, and use quantitative information to navigate day-to-day situations. Literacy skills are typically applied to a variety of consumer decisions, including decisions related to health and finances. The Institute of Medicine’s (2004) definition of health literacy was shared: “the degree to which individuals can obtain, process, and understand the basic health information and services they need to make appropriate health decisions.”

A definition of financial literacy widely adopted by organizations that lead national financial literacy initiatives was also shared: “the ability to use knowledge and skills to manage financial resources effectively for a lifetime of financial well-being” (President’s Advisory Council on Financial Literacy (2008).

Many literacy skills are transferable to several decision-making domains. The overlap in skills required for health and financial decisions were highlighted and illustrated as part of the facilitated discussion.

Guiding questions 1 and 2: Intersections between health and financial wellness

FERMA attendees were asked what they see as the intersections between health and financial wellness. Each attendee was given five index cards and asked to individually write five ideas or answers related to this question. Then, using a sorting process, working in groups, attendees organized the cards into themes.

An initial examination by symposium participants of the themes that emerged identified the following overarching categories: intersections of costs, the need to plan for both health and financial wellness, and the role of stress as both an input and outcome. Another major theme that was identified related to the manner in which policy tends to be made in silos and the acknowledgment that, to really impact health and financial wellness, policy issues also need to be considered. When asked to share a take-away from the discussion, one attendee summed it up like this, “It takes money to stay healthy.”

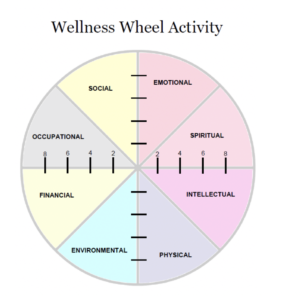

As part of the symposium, FERMA attendees completed a Wellness Wheel activity to self-assess their own personal wellness (O’Neill, 2015). The wheel consists of eight sections, each depicting an aspect of wellness. Physical wellness (health) and financial wellness are two of the sections. The other six sections are emotional, spiritual, intellectual, environmental, occupational, and social. (See Figure 1.)

Figure 1. Wellness Wheel Activity Handout

[Alt tag content for figure 1: A circle divided into 8 equal, differently colored wedges]

[D link content for figure 1: Each wedge of the circle includes one of eight words: emotional, spiritual, intellectual, physical, environmental, financial, occupational, and social.]

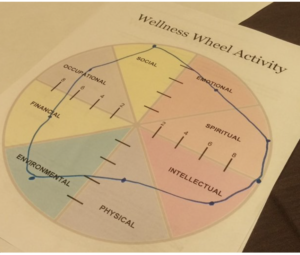

Note that each “slice” of the wheel is equal and contains a vertical line with five equal sections: 0 (central point) to 2, 2 to 4, 4 to 6, 6 to 8, and 8 to 10 (outer edge). Participants were asked to self-assess their wellness in each section by placing a dot on each vertical line and then “connecting the dots.” If people rate themselves a “10” in each aspect of their life, they are “well-rounded” and their dots will connect to make a circle. Few people are all 10s, however. Rather, they perceive areas of weakness and their wheel looks like a “flat tire.” See Figure 2, below.

Figure 2. Completed Wellness Wheel Activity

[Alt tag content for figure 2: Wellness wheel activity completed in “flat tire” configuration.]

To continue the car tire and driving analogy, flat tires make it difficult to steer a car, which can cause an accident and result in difficulty getting to a destination. The same thing is true of areas of weakness in personal wellness. They can result in hardships that make living life difficult.

Because of the sensitive nature of the individual Wellness Wheel assessments, rather than debrief as a group, symposium participants were encouraged to act upon the insights revealed by their personal wellness assessments by answering the following questions for themselves:

- As a result of completing the Wellness Wheel, I intend to improve my life balance by …

- My first step will be …

- I will review my progress on ______ [date].

Guiding question 3: Creating an integrated model of health and financial wellness

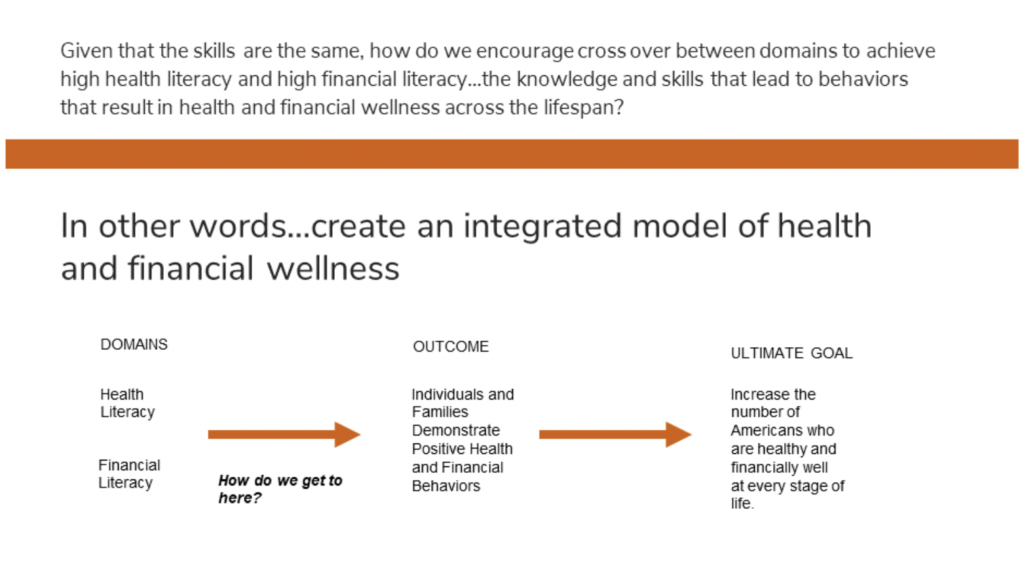

With a shared understanding of the definitions of wellness, financial wellness, health literacy, and financial literacy, participants were given instructions to create an integrated model of health and financial wellness across the life span (Figure 3). The goal was to determine how we, as practitioners, assist individuals and families to demonstrate positive health and financial behaviors which will then increase the number of Americans who are healthy and financially well at every stage of life.

Figure 3: Integrating financial wellness into a health framework

[Alt tag content for figure 3: A chart listing domains, outcome, and ultimate goal.]

[D link content for figure 3: The Domains column lists health literacy and financial literacy with an arrow (captioned How do we get here?) pointing to the Outcome column. The Outcome column says Individuals and families demonstrate positive health and financial behaviors, then a second arrow points to the Ultimate Goal column, which says Increase the number of Americans who are healthy and financially well at every stage of life.]

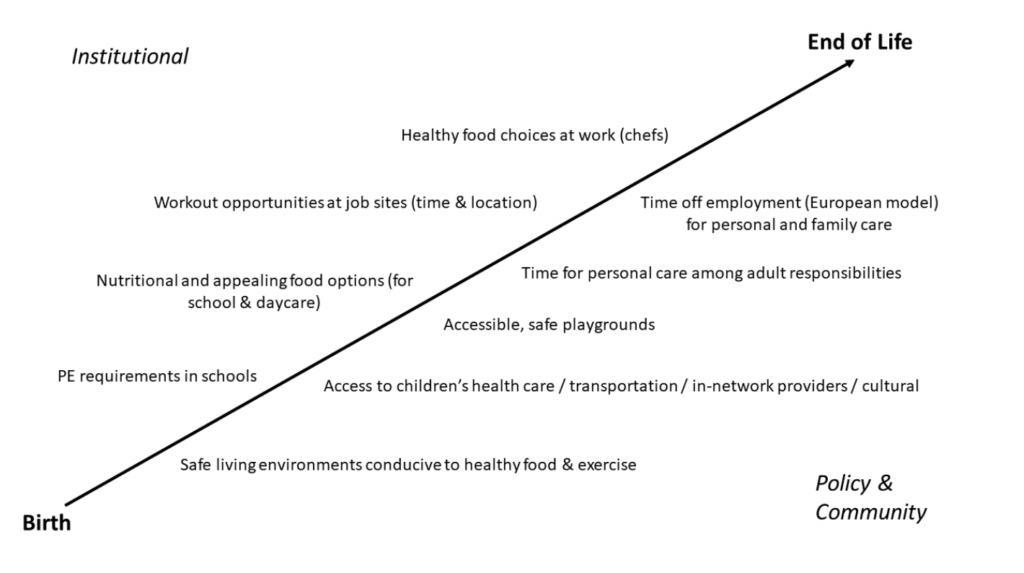

Each group took a different approach to determining how we can obtain the ultimate goal. The images below are a representation of the models that participants developed during the session. One group took a policy systems and environment (PSE) approach across the life span (Figure 4). PSE change approaches seek to go beyond programming and into systems that created the structures in which we work, live, and play. These approaches often work hand-in-hand where, for example, an environmental change may be furthered by a policy or system change (The Food Trust, 2012). This group’s model determined institutional and policy or community strategies to be implemented.

Figure 4: A life span perspective to health and wellness

[Alt tag content for figure 4: A chart detailing institutional and policy/community strategies.]

[D link content for figure 4: At the top left of the chart, the label Institutional sits with four divisions underneath arranged in a diagonal slanting down and to the left. The divisions are, from the top right, Healthy food choices at work (chefs), Workout opportunities at job sites (time and location), Nutritional and appealing food options (for school and daycare), and PE requirements in schools. This half is divided from the bottom half with a diagonal arrow pointing from Birth at the bottom left to End of life at the top right. The policy and community label at the bottom right encompasses five divisions. They are, from the top right, Time off employment (European model) for personal and family care, Time for personal care among adult responsibilities, Accessible and safe playgrounds, Access to children’s health care/transportation/in-network providers/cultural, and Safe living environments conducive to healthy food and exercise.]

Another group took a different approach and brainstormed items needed for practitioners to continue the work (Figure 5). Brainstorming is the method of solving a problem by recording all tentative solutions which occur, postponing judicial evaluation of these solutions to a subsequent time period (Parnes and Meadow, 1959). Using sticky notes, they listed as many things in the time allowed to determine what needed to be included in an integrated model.

Figure 5: Common tools and strategies addressing health and financial wellness

[Alt tag content for figure 5: 12 rectangles of different colors with words in them.]

[D link content for figure 5: Each box contains different terms including Self-help programs,

Overcoming turf issues to work together, Multiple partners, Awareness, Behavior change strategies, Oral health pre-K-lifetime, Clear picture of goal, Quality educational materials, Valid measurement tools, Variety of outreach methods, Cohesive method to collect/determine success, $ funding.]

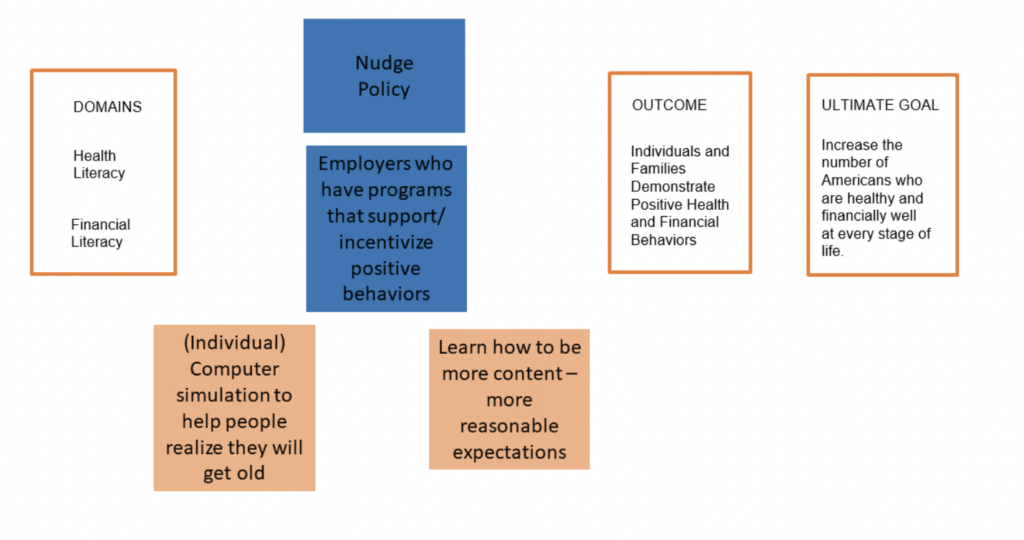

Nudge theory was identified by a third group as a way to encourage behavior change in individuals and families (Figure 6). Nudge theory is a concept in which subtle shifts encourage people to make decisions that are in their broad self-interest (Thaler and Sunstein, 2009).

This group also discussed how employers could help in the process. They identified an intervention of using technology for simulation. Finally, they thought it was important to teach individuals the importance of being content with what they have and to have more reasonable expectations. These elements were included in their vision of an integrated model.

Figure 6: Integrating behavioral concepts to enhance health and financial wellness

[Alt tag content for figure 6: 7 vertical rectangles in orange, blue, and white with orange outline.]

[D link content for figure 6: A blue rectangle at the top is labeled Nudge Policy. From the left, outlined in orange are the domains Health literacy and Financial literacy. Moving right is a blue box with the words Employers who have programs that support/incentivize positive behaviors, next is a white box with orange outline with the title Outcome with the words Individuals and families demonstrate positive health and financial behaviors. Next is the final orange-outlined box with the title Ultimate goal and the words Increase the number of Americans who are healthy and financially well at every stage of life. On the bottom are two orange boxes. The left one says (Individual) computer simulation to help people realize they will get old and the right one says Learn how to be more content — more reasonable expectations.]

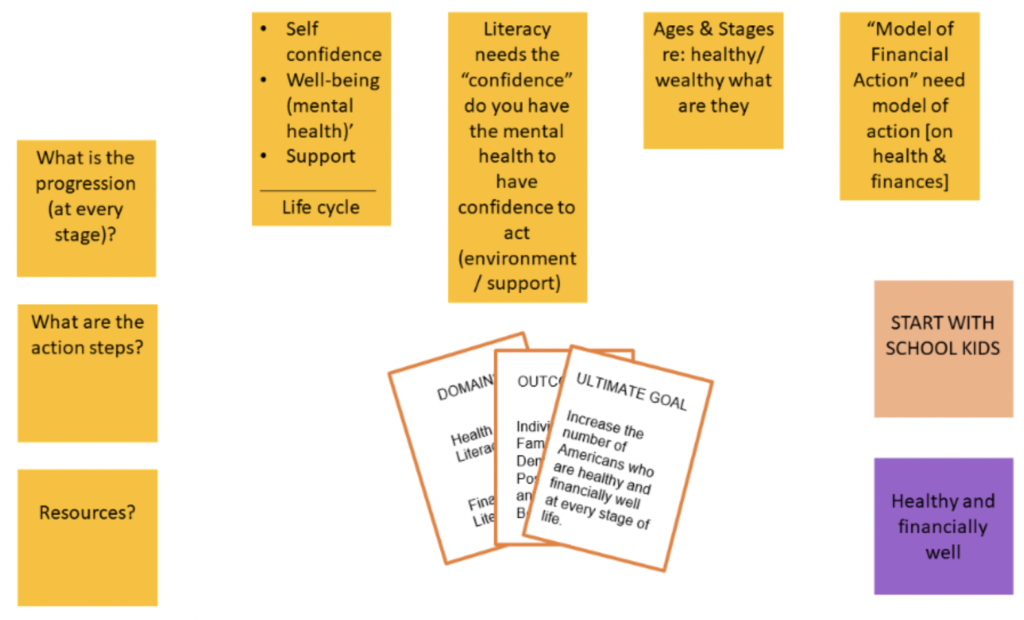

The final group worked through different aspects of what is or would be needed to reach the ultimate goal. They started by asking questions (Figure 7) and then identified the needs to answer those questions. Finally, they determined a starting point.

Figure 7: Points of intervention with health and financial wellness

[Alt tag content for Figure 7: 12 colored boxes with various phrases.]

[D link content for figure 7: Starting at the bottom left, an orange box says Resources?; the orange box above that says What are the action steps?; the orange box above that says What is the progression (at every stage)?; an orange box to the right says Self-confidence, well-being (mental health) support and life cycle; an orange box to its right says Literacy needs the “confidence” do you have the mental health to have confidence to act (environment/support); an orange box to its right says Ages and stages re: healthy/wealthy what are they; an orange box further right says “Model of financial action” need model of action (on health and finances); a peach box below that says Start with school kids and a purple box below that says Healthy and financially well. All of these boxes surround three orange-outlined and fanned boxes listing the Domains, Outcome, and Ultimate goal as stated in previous figures.]

In summary, each group took a different approach and came up with a variety of strategies to address the goal of creating an integrated model of health and financial wellness. By working with a diverse group of practitioners during the symposium, the problem can be viewed from multiple perspectives to gain insights and to determine courses of action that one person could not achieve on their own.

Takeaways from the symposium

As highlighted by the symposium participants, there are many connections between health and financial wellness. Financial and health decisions can be consequential at every stage of the life cycle, highlighting the importance of this connection. Further, the issues of information asymmetry and level of literacy with respect to finances, health, and health insurance are important. Financial professionals, health professionals, and Extension agents need to understand and recognize that interventions to improve consumers’ financial wellness may not be successful without acknowledging its intersection with health wellness and vice versa. Addressing the commonality and the interplay of the two is the key to improving consumers’ overall welfare.

A variety of strategies were developed by symposium participants to address the integration of health and financial well-being. This included aspects of health insurance education, choice framing, and formulating research questions addressing where these intersections are thought to be most impactful.

Many educators and practitioners in personal finance have long recognized the intersection of health and financial wellness. A facilitated discussion among this group helped yield valuable insights and provide systematic thinking about the intersection.

The conversation on the intersections of health and financial wellness among practitioners should be continued. Resources for a holistic approach to wellness (health and financial) can assist individuals and families to lead their best lives across the life span. Typically among practitioners, these two topics have been separate. By combining them and providing education and outreach together, behaviors and outcomes can greatly be improved upon (Vitt et al., 2002). Additional research needs to be conducted to determine what is available and what resources need to still be developed in this emerging field. As the role of health continues to be emphasized in family and consumer science Extension programs, this work will help support and encourage collaborations between these related fields.

References

Braun, B., Bruns, K., Cronk, L., Fox, L.K., Koukel, S., Le Menestrel, S., … Warren, T. (2014). Cooperative Extension’s national framework for health and wellness. https://nifa.usda.gov/sites/default/files/resources/Cooperative_extensionNationalFrameworkHealth.pdf

Conger, R. D., Conger, K. J., & Martin, M. J. (2010). Socioeconomic status, family processes, and individual development. Journal of Marriage and Family, 72(3), 685-704. doi:10.1111/j.1741-3737.2010.00725.x

Consumer Financial Protection Bureau (2015). Financial well-being: The goal of financial education. https://files.consumerfinance.gov/f/201501_cfpb_report_financial-well-being.pdf

Dew, J. P., and Xiao, J. J. (2013). Financial Declines, financial behaviors, and relationship satisfaction during the recession. Journal of Financial Therapy, 4(1). Retrieved from http://dx.doi.org/10.4148/jft.v4i1.1723

Drentea, P., & Reynolds, J. R. (2012). Neither a borrower nor a lender be: The relative importance of debt and SES for mental health among older adults. Journal of Aging and Health, 24(4), 673-695. doi:10.1177/0898264311431304

Fonseca, G., Cunha, D., Crespo, C., and Relvas, A. P. (2016). Families in the context of macroeconomic crises: A systematic review. Journal of Family Psychology, 30(6), 687. doi:10.1037/fam0000230

Institute of Medicine (2004). Health Literacy: A Prescription to End Confusion. Institute of Medicine. Washington, D.C.: National Academies Press.

James, B. D., Boyle, P. A., Bennett, J. S., & Bennett, D. A. (2012). The impact of health and financial literacy on decision-making in community-based older adults. Gerontology, 58(6), 531-539.

Nandi, A., Prescott, M. R., Cerdá, M., Vlahov, D., Tardiff, K. J., & Galea, S. (2012). Economic conditions and suicide rates in New York City. American Journal of Epidemiology, 175(6), 527-535. doi:10.1093/aje/kwr355

National Prevention Council. (2011). National Prevention Strategy. Washington, D.C.: U.S. Department of Health and Human Services, Office of the Surgeon General.

O’Neill, B. (2015). Small Steps to Health and Wealth In-Depth Training-04-15. Retrieved from https://www.slideshare.net/BarbaraONeill/small-steps-to-health-and-wealth-training-for-university-of-missouri-8-hours0415

O’Neill, B., & Ensle, K. (2013). Small Steps to Health and Wealth (2nd Ed.). Ithaca, NY: Plant and Life Sciences Publishing.

Parnes, S. J. & Meadow, A. (1959). Effects of “brainstorming” instructions on creative problem solving by trained and untrained subjects. Journal of Educational Psychology, 50(4), 171-176.

Pinsker, B. (2018). The next frontier in workplace wellness: Financial Health. Reuters. Retrieved from https://www.reuters.com/article/us-world-work-financialwellness/the-next-frontier-in-workplace-wellness-financial-health-idUSKCN1IP1GR

President’s Advisory Council on Financial Literacy. (2008). 2008 Annual Report to the President Executive Summary. Retrieved from https://www.treasury.gov/about/organizational-structure/offices/Domestic-Finance/Documents/exec_sum.pdf

Thaler, R. H. & Sunstein, C. R. (2009). Nudge: Improving decisions about health, wealth, and happiness. New York, NY: Penguin Group.

The Food Trust. (2012). What is Policy, Systems and Environmental (PSE) Change? Retrieved from http://healthtrust.org/wp-content/uploads/2013/11/2012-12-28-Policy_Systems_and_Environmental_Change.pdf

Unser, R. (2018). More buzz than action with financial wellness? Forbes. Retrieved from https://www.forbes.com/sites/rickunser/2018/04/17/more-buzz-than-action-with-financial-wellness/#f1369b531c3c

Vitt, L. A., Siegenthaler, J. K., Siegenthaler, L., Lyter, D. M., & Kent, J. (2002, January). Consumer health care finances and education: Matters of values. Issue Brief Number 241. Washington D.C.: Employee Benefit Research Institute.

World Health Organization. (1948). Constitution of the World Health organization. Retrieved from http://www.who.int/governance/eb/who_constitution_en.pdf