An Evaluation of Women and Money: Unique Issues

Martie Gillen

University of Florida

Lynda Spence

Diann Douglas

Brenda C. Williams

University of Florida /IFAS Alachua County Extension Service

Abstract

Women and Money: Unique Issues, an Extension curriculum series developed by the University of Florida, is designed to increase women’s financial literacy and capability.From 2012 to 2015, 258 participants completed the program. Evaluations of the 2012 pilot study (n=91) indicated that 1) 100 percent of the participants learned about unique money issues facing women today; 2) 100 percent of the participants identified and set financial goals; and 3) 97 percent of the participants developed household spending plans. From before to after attending the Women and Money: Unique Issues program, 2013-2015 (n=167) participants increased their ability to manage their finances in all areas. Paired sample t-tests were conducted using a retrospective pre- then post- test design and statistically significant increases in perceived financial abilities were documented across all 10 areas. Twenty-six percent of the participants completed a six-month follow up survey to identify behavior changes.

Key words

Extension, women, money, personal finance, financial education, life cycle

Introduction

Changing societal dynamics and their effects on gender roles and family structures underscore a distinct need for financial management education to address the unique issues that women may encounter. Women and Money: Unique Issues, a curriculum series developed by the University of Florida, is designed to provide women with information and encouragement about being financially successful. This series includes financial management for women across the life cycle including through family transitions. Establishing the unique issues women may face, the multi-session curriculum builds on financial organization, money communication, goal setting, asset protection, estate planning, and concludes with retirement.

“Economic insecurity is a pervasive threat for women of all ages, and the economic security gender gap persists across and throughout the lifespan” (Wider Opportunities for Women 2012, 2). While, women have made great strides in educational achievement, surpassing males for graduation rates from college with a Bachelor’s degree or higher, comprise almost half of the labor force, and are increasingly the breadwinner in dual income households, the fact remains that the earnings for full-time year round working women equate to only 78 percent of their male counterparts or 78 cents for every dollar earned (Council of Economic Advisers, 2014). Women are also more likely than men to leave the work force to provide caregiving for a family member (Family Caregiving Alliance 2012). Increasingly, women are solely responsible for financial decision making at some point in their lives, yet on average, they have a lower level of financial literacy than their male counterparts (Delavande et al. 2008; Chen and Volpe 2002; Lusardi and Mitchell 2008)

Forty-two percent of women lack financial security (Wider Opportunities for Women 2012). The situation is even more dire for single mothers, as only 18 percent have financial security, and older women, as 60 percent cannot afford to cover their basic needs (Wider Opportunities for Women 2012). In addition, the statistics on women’s perceived economic security are startling. Findings from a recent annual survey on retirement indicate that “only 7 percent of women are ‘very confident’ in their ability to fully retire with a comfortable lifestyle, 43 percent of women expect to work past age 70 or do not plan to retire, more than half (52 percent) plan to work after they retire, most (65 percent) baby boomer women do not have a backup plan if forced into retirement sooner than expected, of women who have or plan to take time out of the workforce to be a caregiver, 74 percent believe that it will negatively impact their ability to save for retirement, the majority (59 percent) of women who estimate their financial need guess what their retirement savings needs would be rather than using a calculator or advisor, and only 35 percent of women used a professional financial advisor” (Collinson 2014, 1).

Program Overview

Uniquely positioned, Family and Consumer Sciences has responded programmatically to the changing roles and responsibilities of women in these uncertain economic times by developing education programming that addresses the unique money issues facing women today. Women and Money: Unique Issues is designed as a ten-hour series and is generally offered over five days. Program participants learn how financial familiarity and management positively influence their quality of life and understand how emotions influence how they use their money. Refer to Gillen et al. (2014) for additional descriptive program information.

Lesson 1: Introduction to Women and Money. This lesson explores the unique issues women may face throughout their life cycle. Topics covered include life events such as marital status changes, caregiving, employment, earnings, retirement planning, gender comparisons, and generational comparisons (Gillen et al. 2014).

Lesson 2: Money Basics. This lesson includes organizing important documents, setting S.M.A.R.T. financial goals, exploring emotional uses of money, tracking spending, and developing a spending and saving plan (Gillen et al. 2014).

Lesson 3: Protecting Your Assets. This lesson focuses the risk management process including insurance products such as life insurance, health insurance, disability insurance, long-term care insurance, auto insurance, homeowner’s insurance, flood insurance, and renter’s insurance. Also included in this lesson is information about detecting identity theft and avoiding fraud, scams and deception. Participants learn how to exercise their rights if they become a victim of fraud (Gillen et al. 2014).

Lesson 4: Basic Investing. This lesson includes basic investment principles including building wealth through investment strategies, risk tolerance, portfolio building, consulting a financial advisor, and retirement investing options including employer provided retirement plans and individual alternatives (Gillen et al. 2014).

Lesson 5: Estate Planning. This lesson includes creating your estate plan including the elements of an estate plan such as health care and financial advanced directives, communicating your wishes, estate tax considerations, and facing the loss of a spouse (Gillen et al. 2014).

Impacts

From 2012 to 2015, 258 participants completed the program. Participants were recruited at the county level. The series was piloted four times in 2012 in Florida. Ninety-one participants whose ages ranged from 21-83 participated in the pilot study. Results from the pilot study indicated that 1) 100 percent of the participants learned about unique money issues facing women today; 2) 100 percent of the participants identified and set financial goals; and 3) 97 percent of the participants developed household spending plans (Gillen et al. 2014).

During 2013-2015, 167 participants completed the program. A retrospective pre- then post- test evaluation instrument was used to assess self-reported gains in perceived abilities as a result of participation in the Women and Money: Unique Issues program. Participants responded to a statement which read: “Back before attending Women and Money: Unique Issues, I was able to…. and Now after attending Women and Money: Unique Issues I am able to…” Participants were instructed to circle the number that rates their ability to carry out each financial topic before completing the Women and Money: Unique Issues program and then circle the number that shows their ability to carry out each financial topic after the lesson. Responses were presented in a Likert fashion ranging from 1 = strongly disagree to 5 = strongly agree. In addition to measuring a change in perceived financial ability, participants were asked to respond to a series of three action statements. Key actions included developed a spending plan, developed an investment plan, and developed an estate plan as a result of attending the Women and Money: Unique Issues program.

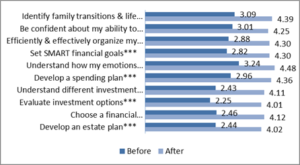

From before to after attending the Women and Money: Unique Issues program, participants increased their ability in all areas. Paired sample t-tests were conducted to compare the mean pretest score to the mean posttest score for each topic. Statistically significant increases in financial knowledge across all 10 areas were noted including identifying family transitions and life cycle issues affecting women’s finances, being confident about my ability to make successful financial decisions, efficiently and effectively organizing my financial documents, setting SMART goals, understanding how my emotions influence how I use my money, developing a spending plan, understanding different investment options, evaluating investment options, choosing a financial professional/advisor, and developing an estate plan. See the below figure for 2013-2015 results (n=167).

Ninety percent of the participants developed a spending plan. Seventy-nine percent of the participants developed an investment plan. Sixty-three percent of the participants developed an estate plan.

In addition, 26 percent of the 2013-2014 participants completed a six-month follow up survey. Forty percent of the respondents saved money ranging from $150 to $5,000; 38 percent met with a financial planner; 56 percent organized their personal finance documents; and 87 percent continued to track their spending.

Conclusion

While women have made advances in education and labor force participation, many women continue to face economic challenges across their life cycle. Research has shown that women are not confident when planning their financial future as evident in retirement planning. Family and Consumer Sciences developed the Women and Money program to provide consumer education regarding the unique financial management issues that women may encounter throughout their lifecycle. This program has potential to be duplicated nationally in other rural and urban communities.

Figure. 2013-2015 Participant Abilities from Before to After (n=167)

Note: *** p < .001

References

Chen, H. and R. P. Volpe. 2002. Gender differences in personal financial literacy among college students. Financial Services Review 11: 289-307.

Collinson, C. 2014. Fourteen facts about women’s retirement outlook…and seven steps to improve it, assessed January 20, 2016, accessed January 20, 2016, www.transamericacenter.org/docs/default-source/resources/women-and-retirement/tcrs2014_report_women_and_retirement_14_facts.pdf

Council on Economic Advisers. 2014. Eleven facts about American families and work, accessed January 20, 2016, www.whitehouse.gov/sites/

default/files/docs/eleven_facts_about_family_and_work_final.pdf

Delavande, A. S. Rohwedder, and R. Willis. 2008. Preparation for retirement, financial literacy and cognitive resources, Working Paper Series, Michigan Retirement Research Center.

Family Caregiving Alliance. 2012. Selected caregiver statistics, assessed August 30, 2013, https://www.caregiver.org/caregiver-statistics-demographics

Gillen, M., Spence, L., Douglas, D., and Williams, B. 2014. Providing money management education to women through Extension – Women and Money: Unique Issues, The Forum for Family and Consumer Issues 19(1).

Lusardi, A. and O. Mitchell. 2008. Planning and financial literacy: How do women fare? American Economic Review 98: 413-417.

Wider Opportunities for Women. 2012. Doing without: Economic insecurity and older Americans, accessed January 20, 2016, www.wowonline.org/documents/OlderAmericansGenderbriefFINAL.pdf

Back to table of contents ->https://www.theforumjournal.org/2017/08/29/summerfall-2016-vol-20-no-2/