Teaching Consumers to Understand and Estimate Health Care Costs

Jesse Ketterman Jr.

University of Maryland Extension

Maria Pippidis

University of Delaware Cooperative Extension

Virginia Brown

University of Maryland Extension

Bonnie Braun

University of Maryland

Abstract

Consumers are confused about health insurance. According to Consumers Union (Quincy, 2012), consumers struggle with health insurance decisions because of low health insurance literacy and the complexity of products. This results in consumers struggling to understand and estimate health care costs. Cooperative Extension Systems from two states developed an educational program with modules that seeks to reduce confusion, increase capability, and increase confidence when choosing and using health insurance. The module reported here is designed to help consumers understand types of health care expenses, know where to go for information about health care expenses, and use tools to help estimate out-of-pocket health care costs.

Key Words

health insurance literacy, estimating health care costs, health insurance terms

Introduction

Since the passage of the Affordable Care Act (ACA), Cooperative Extension has played an active role in educating consumers on how to choose and use health insurance. In 2011, the Consumers Union, University of Maryland College Park, and American Institutes of Research (AIR) hosted a roundtable to define health insurance literacy and how to measure it. Health insurance literacy is defined as the “… knowledge, ability, and confidence to find and evaluate information about health plans, select the best plan for his or her family for their own or their family’s financial and health circumstances, and use the plan once enrolled” (Quincy, 2012). In 2012, University of Maryland Extension and University of Delaware Cooperative Extension collaborated to launch the Health Insurance Literacy Initiative (HILI). HILI has produced evidence-based, empowerment programs intended to reduce confusion, increase capability, and increase confidence of consumers to make a smart choice and use decisions about health insurance.

The HILI team initially developed a comprehensive, two-hour curriculum that assists consumers in choosing a health insurance plan then added a one-hour module focused on basics needed to make a health insurance decision. Both produced evidence of positive change. The team then developed a series of modules focused on using health insurance, understanding health insurance benefits, and understanding and estimating health care costs. This article describes the pilot study of the Smart Use Health Insurance: Understanding and Estimating Health Care Costs module conducted over a two-year period of 2017 to 2018.

Program need

Under the ACA, uninsured consumers were expected to make an enrollment decision — one that requires a relatively high level of prose, document, and numerical literacy. They joined millions of other people enrolling in employer, public, or private health insurance options. Making decisions that meet both individual and family health needs while considering financial resources is challenging yet essential to the well-being of American families (Kim, Braun, and Williams, 2013). Possessing high levels of both health literacy and financial literacy is necessary, given the complexity of the health insurance industry and the abundance of choices in coverage.

Health literacy. Most Americans have been shown to be deficient in both health literacy and financial literacy measures. Of the U.S. population, 36 percent of adults are at a low level of health literacy and only 12 percent have “proficient” health literacy, necessary to read long and complex health-related communications (Kutner, Greenburg, Jin, and Paulsen, 2006). Almost 90 percent of adults report difficulty using health information to make an informed health decision (America’s Health Insurance Plans, 2013).

Financial literacy. In one study, Americans correctly answered an average of 3.2 questions on a six-question financial literacy test and one in five reported having unpaid, past-due medical bills (Financial Industry Regulatory Authority, 2016). In another study, 45 percent of U.S. adults gave themselves a grade of C, D, or F on their knowledge of personal finance (National Foundation for Credit Counseling, 2018), indicating a subjective rating of below-average to failing scores on financial literacy. The Report on Economic Well-Being of U.S. Households (Federal Reserve System, 2018) indicates that one out of four adults skipped medical care because of cost and one in five adults had major, unexpected medical bills to pay.

Health insurance literacy. When health literacy and financial literacy come together to form health insurance literacy, most Americans are not literate; they lack understanding of 1) basic health insurance terms like premium, deductible, and copayment, and 2) how to use their health insurance (American Institutes for Research [AIR], 2014; Schiavone, 2013;). One study found that more than half of the respondents were unable to define at least one of the common health insurance terms (Schiavone, 2013) and another study found that only 20 percent could correctly estimate the cost incurred during a routine doctor visit (AIR, 2014).

Several studies suggest that consumers want to better understand health insurance terminology, plan costs, and the details of their health insurance benefits (Kim et al, 2013; Quincy, 2012; Sinaiko and Hirth, 2011). Most adults (75 percent) in the United States were moderately or very confident that they knew how to use health insurance, yet when presented with a cost-sharing scenario, only 20 percent could estimate the correct cost of a doctor’s visit (Paez et al., 2014). The study also found that 42 percent of those surveyed were unlikely or somewhat likely to find out what their health plan covered before they went for health care services (Paez et al., 2014).

Program theoretical frameworks

The Smart Choice – Smart Use Health InsuranceTM modules produced by the HILI team are grounded in multiple theories, combining key concepts from Social Cognitive (Bandura, 1986); Planned Health Behavior (Azjen, 1985); Stages of Change (Prochaska, Di Clemente, and Norcross, 1992); and Adult Learning (Boyle, 1981; Knowles, 1973). We then designed the modules for content and delivery based on these theories. From the theories, we created our main pilot test question: To what extent does the learning module reduce confusion, increase capability and increase confidence?

Overview of the programmatic materials

The Understanding and Estimating Health Care Costs module was designed to improve the understanding of health care costs, explore ways to identify where to find cost information, and plan for health care expenses. The 1½ hour module includes a PowerPoint presentation, informational materials, and fillable forms. The presentation includes an interactive activity to emphasize health insurance terms such as premium, deductible, and out-of-pocket maximum. Using a case study, participants review and apply content to an estimation activity. Participants practice estimating how much to save each month, over and above the premium, to cover health care costs.

Participants receive a folder of materials at the beginning of the module. Materials include definitions of terms, how to save for medical expenses using flexible spending accounts and health savings accounts, and explanations of out-of-pocket costs. Fillable forms are used by participants to work through a case study, estimate health care expenses, and develop monthly spending plans. Additional forms, fact sheets and worksheets that should be completed at home with participants’ personal information are also provided. These documents, with auto fill capability, are available electronically at the HILI Web site (extension.umd.edu/insure). Participants also receive information about where to find reliable resources on the internet.

The module is designed for multiple audiences and is delivered as consumer education, professional development, and in a train-the-trainer format. The module is taught through face-to-face and on-line methods of delivery.

Pilot test study

The pilot study is designed to test the extent to which the learning module increased confidence among consumers who completed the program therefore reducing confusion and increasing competence. Items for the pre- and post-test survey were drawn from the bank of items provided by the AIR. Drawing from the bank of AIR items, the pre- and post-test survey included three items to measure the impact of the pilot test.

The pilot was conducted by six Extension Educators in four states (Delaware, Iowa, Minnesota, and Maryland) who taught in-person and via webinars between 2017 and 2018. Educators were required to complete the Understanding and Estimating Health Care Costs train-the-trainer workshop, which includes a session on adult learning, theory, and evaluation, prior to facilitating the program.

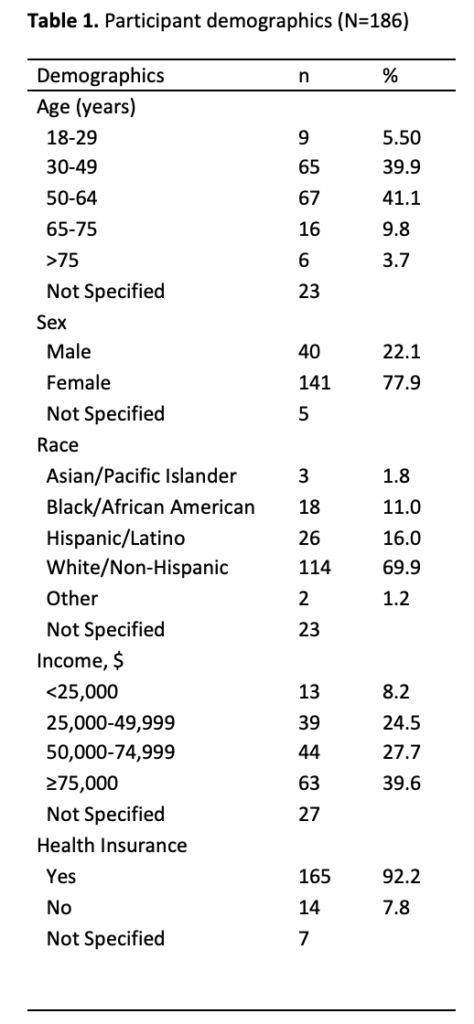

There were 186 consumers who participated in the pilot test workshops. Demographic measures included age, sex, race, income, and possession of health insurance. The majority of participants were female (77.9 percent), with 86.5 percent stating they were between ages 30 and 64. The most commonly reported racial group was white/non-Hispanic (69.9 percent), followed by Hispanic/Latino (16 percent). Income was split fairly evenly, with 39.6 percent reporting an income of $75,000 or higher, followed by almost 27.7 percent reporting $50,000 to $74,999, 24.5 percent reporting $25,000 to $49,999, and the rest reporting less than $25,000. Of the total sample, the overwhelming majority (92.2 percent) reported having health insurance. Table 1 shows the summary of participant demographics.

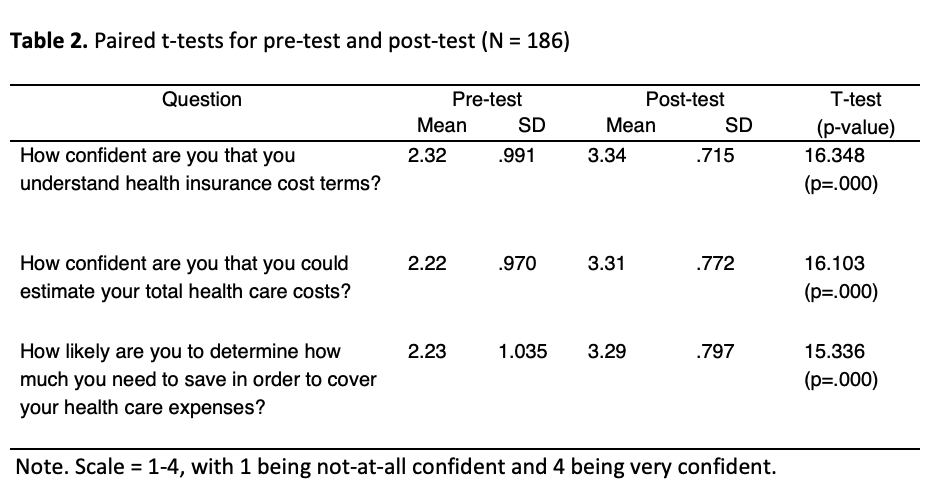

Participants were asked two questions relating to confidence. An additional question was asked to determine if participants were likely to utilize the information to determine costs. Paired-sample t-tests were conducted to determine the mean difference between the pre-test and post-test. Statistically significant differences (p > .001) were noted with all three questions. Results are found in Table 2.

Implications for Cooperative Extension and other educational programming

Cooperative Extension is the noncredit education network that addresses public needs as part of each state’s land-grant university. Prior studies suggest that consumers want to better understand health insurance terminology, plan costs, and details of their health insurance benefits (Kim et al, 2013; Quincy, 2012; Sinaiko and Hirth, 2011).

Based on the results of this pilot test, the Understanding and Estimating Health Care Costs module increases confidence in understanding health insurance cost terms and in estimating health care costs. Using the module also increases likelihood that consumers will determine what they need to save to cover health care expenses when they use their health insurance.

This module, in addition to the other modules developed and tested by the Health Insurance Literacy Initiative team can be used by Extension Educators and others who complete the HILI Certified Educator Course to provide health insurance literacy education in communities. The certification enables Extension Educators and other educators to provide consumer education and professional development. Upon completion of certification, educators have access to all materials needed to deliver the modules and the items to test impact. Educators can trust that if they hold to the fidelity of the research-based modules, they will have similar results. They can expect to see increases in consumer confidence and capability.

Programmatic content that shows and explains the links between health, health insurance, and financial literacy in a practical way is of benefit to consumers. Taking the confusion out of choosing and using health insurance increases consumers ability to access care, stay healthy, and use their financial resources wisely.

Acknowledgements

The Health Insurance Literacy Initiative was developed with funding from the University of Maryland Extension, the College of Agriculture and Natural Resources, and the University of Delaware Cooperative Extension. Additional team members at the time of the study include Lynn Little, Teresa McCoy, Lisa McCoy, Chenzi Wang, Sara Radice, and Ali Hurtado.

References

Ajzen, I. (1985). From Intentions to Actions: A Theory of Planned Behavior. In J. Kuhl and J. Beckmann (Eds.), Action-control: From cognition to behavior (pp. 11-39). Heidelberg: Springer.

American Institutes for Research. (2014). Development of the health insurance literacy measure (HILM): Conceptualizing and measuring consumer ability to choose and use private health insurance. Journal of Health Communication, 19(2), 225–239.

America’s Health Insurance Plans (2013). Health Literacy and America’s Health Insurance Plans: Laying the Foundation and Beyond. Summaries of the Health Literacy Activities in 30 AHIP Member Companies. Third Edition. Retrieved from https://www.ahip.org/wp-content/uploads/2013/11/HealthLiteracyBook2013_Third_Edition.pdf

Bandura, A. (1986). Social foundations of thought and action: A social cognitive theory. Englewood Cliffs, NJ: Prentice-Hall, Inc.

Boyle, P.G. (1981). Planning better programs. New York: McGraw-Hill.

Federal Reserve System (2018). Report on the Economic Well-Being of U.S. Household in 2017. Retrieved from https://www.federalreserve.gov/publications/files/2017-report-economic-well-being-us-households-201805.pdf.

Financial Industry Regulatory Authority (2016). FINRA Financial Capability in the United States 2016. Retrieved from http://www.usfinancialcapability.org/downloads/NFCS_2015_Report_Natl_Findings.pdf.

Kim, J., Braun, B., and Williams, A.D. (2013). Understanding health insurance literacy: A literature review. Family and Consumer Sciences Research Journal, 42, 3-13.

Knowles, M.S. (1973). The adult learner: A neglected species (2nd ed.). Houston: Gulf Publishing Company.

Kutner, M., Greenburg, E., Jin, Y., and Paulsen, C. (2006). The Health Literacy of America’s Adults: Results from the 2003 National Assessment of Adult Literacy (NCES 2006-483). Washington, D.C.: National Center for Education Statistics.

National Foundation for Credit Counseling (2018). The 2018 Consumer Financial Literacy Survey. Retrieved from https://nfcc.org/wp-content/uploads/2018/04/NFCC_BECU_2018-FLS_datasheet-with-key-findings_031318-002.pdf.

Paez, K.A., Mallery, C.J., Noel, H., Pugliese, C., McSorely, V.E., Lucado, J.L., and Ganachari, D. (2014). Development of the Health Insurance Literacy Measure (HILM): Conceptualizing and measuring consumer ability to choose and use private health insurance. Journal of Health Communication: International Perspectives, 19(Supple.2), 225-229.

Prochaska, J.O., Di Clemente, C.C., and Norcross, J.C. (1992). In search of how people change: Applications to the addictive behaviors. American Psychologist, 47, 1102-1114.

Quincy, L. (2012). Measuring health insurance literacy: A call to action. Retrieved from

https: //advocacy.consumerreports.org/research/measuring-health-insurance-literacy-a-call-to-action/

Schiavone, J. (2013). Half of U.S. Adults Fail ‘Health Insurance 101’. Retrieved from http://blog.aicpa.org/2013/09/half-of-us-adults-fail-health-insurance-101.html#more.

Sinaiko, A.D. and Hirth, R.A. (2011). Consumers, health insurance, and dominated choices. Journal of Health Economics, 30 (2), 450-57.