Impacts of Youth Financial Literacy Education Through 4-H TRY Teams

Stacey S. MacArthur

Utah State University

Amanda H. Christensen

Utah State University

Zurishaddai Garcia

Utah State University

Margie Memmott

Utah State University

Paul Hill

Utah State University

Emy Swadley

Utah State University

Abstract

Research shows one of the issues with financial education is creating curricula that appeal to the interests and needs of learners (O’Neill, Xiao, Bristow, Brennan, & Kerbel, 2000). It has also been shown that youth thrive with a peer-to-peer teaching approach to personal finance education (Garcia et al., 2017). Utah 4-H and Fidelity Investments® collaborated to teach youth financial literacy through a peer-teaching experience. A unique technology component called Scratch was used to reinforce financial concepts. Results show that youth participants increased knowledge and agreement of financial concepts as a result of participating in the program. A program description about the Money Mentors program, use of TRY Teams (Teens Reaching Youth), results and impacts, and important implications for Extension personal-finance education are discussed.

Keywords: financial literacy, 4-H, youth, TRY teams, education

Introduction

A limited understanding of money management combined with little experience managing personal finances may lead youth to make poor financial decisions that could have lasting effects (Royer, Jordan, & Harrison, 2005). Research shows a clear and compelling need for financial education for children and youth (McCormick, 2009). However, the traditional approach to teaching about money management is often perceived as uninteresting and dull (Romer, 2017). Creating a curriculum that appeals to the interests and needs of young learners is critical for success (O’Neill, Xiao, Bristow, Brennan, & Kerbel, 2000).

Youth thrive with a peer-to-peer teaching approach to personal-finance education (Garcia et al., 2017). Youth expressed enjoyment in learning and training others in financial concepts commonly geared toward adults. A program description about this peer-to-peer approach called Teens Reaching Youth (TRY Teams), its outcomes and impacts, and important implications for Extension education are discussed below.

Program description

Utah 4-H and Fidelity Investments® collaborated to produce the Money Mentors curriculum (Christensen et al., 2014). This curriculum was used to provide peer-to-peer financial-literacy instruction to increase financial knowledge, skills, and attitudes in underserved youth. Youth are taught how to teach peers about money-management concepts. Money Mentors was developed with a focus on engaging, relatable, learn-by-doing financial-literacy activities. Six curriculum lessons include the following:

- Planning for Success

- Creating a Spending Blueprint

- Save Your Bacon

- Credit: Know Your Stuff

- Discover a Dollar’s Potential

- Invest in Yourself

Methods

The Money Mentors curriculum was taught to TRY Teams, each made up of three to five youths (n=81) at a statewide event. The training included age-appropriate teaching techniques, experiential-learning ideas, personal-finance content, and a technology component.

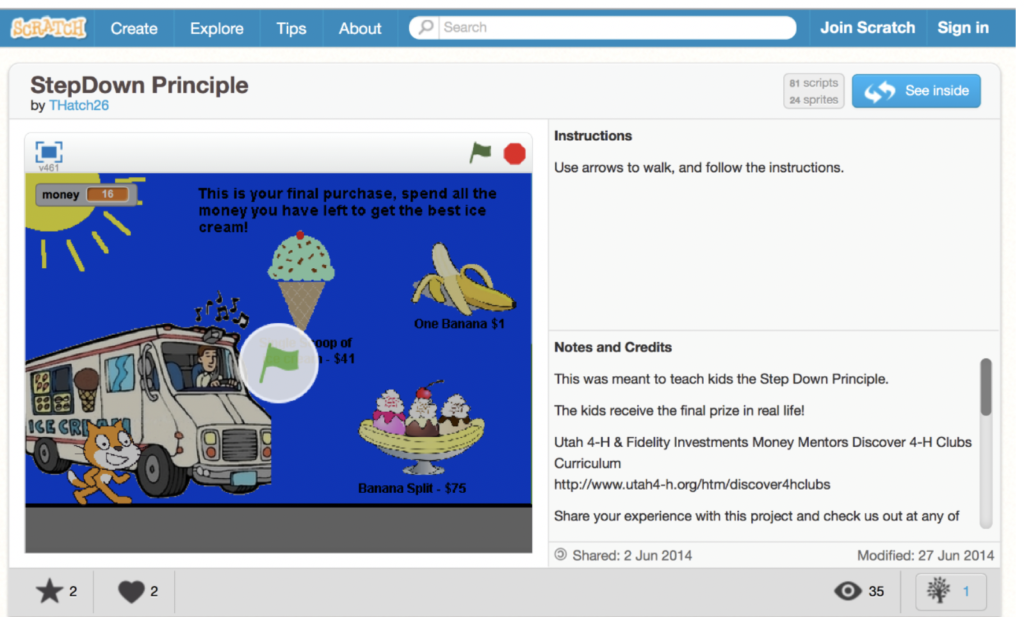

The technology component used in TRY training was Scratch, the free, on-line computer-coding program developed by the Massachusetts Institute of Technology (MIT) Media Lab. Scratch enables the creation of interactive games using basic drag-and-drop coding principles. TRY participants coded a game that taught a financial-literacy principle such as saving, investing, or budgeting to help solidify concepts. (See figures 1-3 for examples.)

Figure 1. The Utah 4-H Money Mentors Scratch studio.

[Alt tag content for Figure 1. Screen grab of Money Mentors Scratch games homepage.]

Figure 2. Example of a Scratch coding screen used by the participants.

[Alt tag content for Figure 2: Screen grab of Scratch coding screen.]

Figure 3. Example of a youth-created Scratch game teaching the step-down principle.

[Alt tag content for Figure 3: Screen grab of Scratch game teaching step-down principle.]

Next, TRY Team members returned to their home counties to teach at least 15 youth participants for at least 6 hours using activities from the curriculum and the Scratch component. Fifteen TRY Teams (81 teens) taught a total of 530 youth participants throughout Utah during the 5-month program period.

Program evaluation

TRY Team members (n=81) were evaluated in person before TRY training and on-line 5 months later after the Money Mentors program teaching experiences. Financial behavior questions were added to this follow-up questionnaire. Questions included assessment of how well financial concepts were understood (e.g., SMART financial goals, etc.); agreement with financial statements (e.g., my personal habits and attitudes affect my spending choices, etc.); and knowing how to use financial knowledge (e.g., create a spending plan, etc.). After their teaching experience, participants were asked about their behavior as a result of participating in the program (e.g., I have started saving more money, etc.).

Youth participants (n=530) who were taught by the TRY Teams were evaluated in person at the conclusion of their county training using a written questionnaire. Participants were asked to mark whether financial statements were True, False, or Unsure (e.g., Human capital can increase the salary I earn at work; I can use the step-down principle to save money, etc.). Since youth participants were only evaluated after the program, the instrument was also administered to a control group of the same age (n=198) for comparison.

Results and impacts

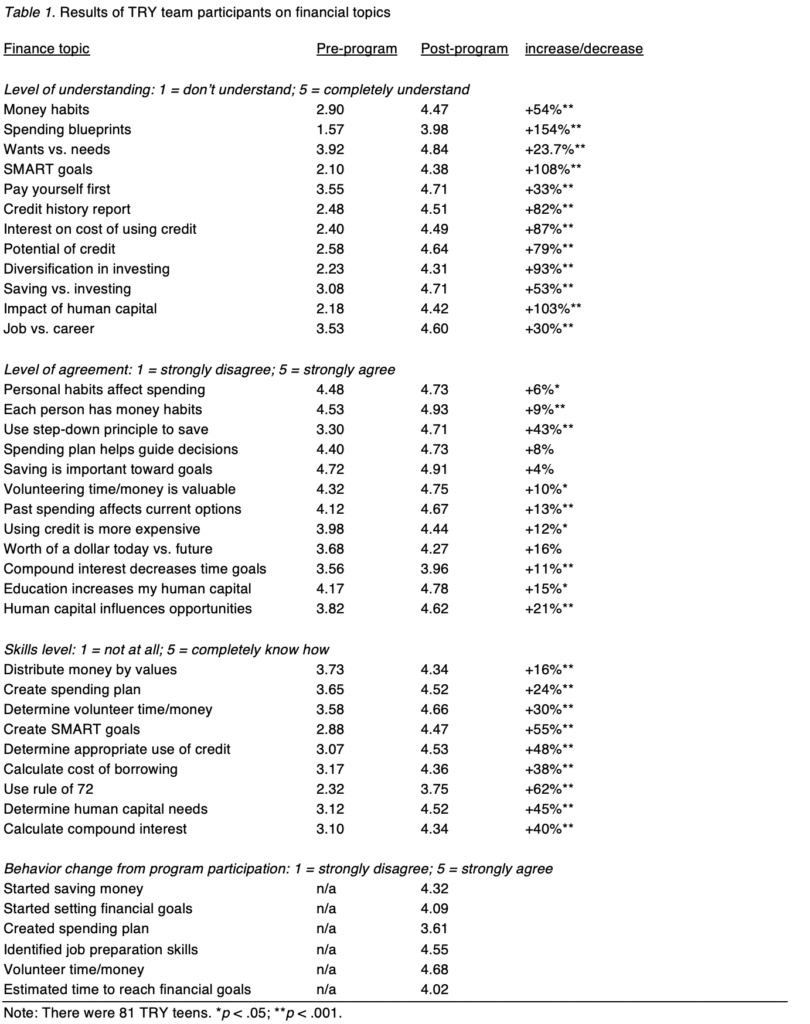

Results show that TRY Team members increased their understanding, agreement, and skills related to financial topics as a result of participating in the Money Mentors program (See Table 1). In addition, TRY Team members used their knowledge to improve their financial behaviors after 5 months of participation (See Table 1). Lastly, long-term impact possibilities are presented.

[Alt tag content for Table 1. Table shows participants’ financial concept scores between pre and post program.]

All results from TRY teens moved in the expected positive direction. Youth showed the most change or learning on concepts that were unfamiliar to them such as creating SMART goals or spending blueprints, and determining the human capital needed for future career goals. Other concepts, such as volunteering time and money, were already familiar and in practice, to a degree, before the program. Behavior changes from participating in the program were encouraging for TRY teens that showed they began using the knowledge and skills they learned.

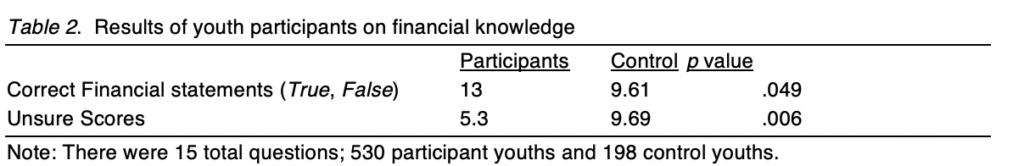

Youth participant results showed significant difference between program and control youth on financial concepts. Program youth on average were able to correctly identify (True/False) 13 of 15 financial statements versus only 5.3 for control youth. In addition, control youth had much higher unsure scores than participant youth (see Table 2).

[Alt tag content for Table 2. Table explains the participants versus the control group on correct and unsure financial statement scores.]

The anticipated long-term impacts of participating youth include informed financial decision-making which can lead to less risky financial behavior. The need for financial-literacy education will only increase with literacy rates drastically falling, and research advocating for improvement of youth well-being and outcomes through financial education and decision-making (Beverly & Burkhalter, 2005).

Implications for Extension

Future steps for continued research might include a long-term, follow-up questionnaire of financial action that demonstrates skills learned by TRY Team participants. Evaluation or updates of the Money Mentors curriculum will ensure ongoing, up-to-date financial information. Evaluative data and results might also be enhanced by sharing the Money Mentors program, supporting curriculum, and the evaluation instrument with other Extension professionals to implement the program in their county or state.

With the financial support of Fidelity Investments®, USU Extension 4-H was able to develop an innovative solution to meet this need and provide a free, ongoing resource through the Money Mentors program. Although the curriculum is free and the program can be replicated without funding, partnering with local businesses might connect Extension professionals to additional resources including advertising, meeting spaces, in-kind donations, food, money for supplies, and volunteers. Banks and credit unions have community-development funds that may be used for this purpose. Supplies such as books, games, and teaching tools could be purchased once and used for multiple programs.

One of the issues with financial education is creating curricula that appeal to the interests and needs of learners (O’Neill et al., 2000). The Money Mentors curriculum addresses this challenge by providing interactive, appealing, and engaging methods of instruction such as Scratch that teach research-based concepts.

The curriculum content is freely accessible on-line at discover4h.org. Providing on-line, research-based materials that can be easily accessed by Extension professionals and volunteers is critical to the ongoing success and relevance of Cooperative Extension. In addition, numerous youths expressed enjoyment in learning and training others in financial concepts traditionally geared toward adults. This combination paves the way for a promising future in financial literacy among youth.

References

Beverly, S. G., & Burkhalter, E. K. (2005). Improving the financial literacy and practices of youths. Children and Schools, 27(2), 121-124.

Christensen, A., Memmott, M., & MacArthur, S. (2014). Discover Utah 4-H and Fidelity Investments® Money Mentors Clubs. Retrieved from http://utah4h.org/htm/discover4hclubs/

Garcia, Z., Francis, D., Christensen, A., MacArthur, S., Memmott, M., & Hill, P. (2017). The Money Mentors Program: Increasing Financial Literacy in Utah Youths. Journal of Extension. 55(6). 6IAW1. Retrieved from: https://joe.org/joe/2017december/iw1.php

McCormick, M. H. (2009). The effectiveness of youth financial education: A review of the literature. Journal of Financial Counseling and Planning, 20(1).

O’Neill, B., Xiao, J., P., Bristow, B., Brennan, P., & Kerbel, C., (2000). Personal Finance Education: Preferred Delivery Methods and Program Topics. The Forum for Family and Consumer Issues. 5(1). Retrieved from: https://www.theforumjournal.org/2000/03/04/personal-finance-education-preferred-delivery-methods-and-program-topics/

Romer, T. (2017). Young Money: A powerful 5 step money plan to financial success now. Networlding.com: Networlding Publishing.

Royer, L., Jordan, J., & Harrison, M. (2005). How Financially Literate are Today’s Youth? Their Current Practices and What We Need to Know as Educators. The Forum for Family and Consumer Issues. 10(1). ISSN 1540 5273. Retrieved from: https://www.theforumjournal.org/2005/05/03/how-financially-literate-are-todays-youth-their-current-practices-and-what-we-need-to-know-as-educators